TAXES

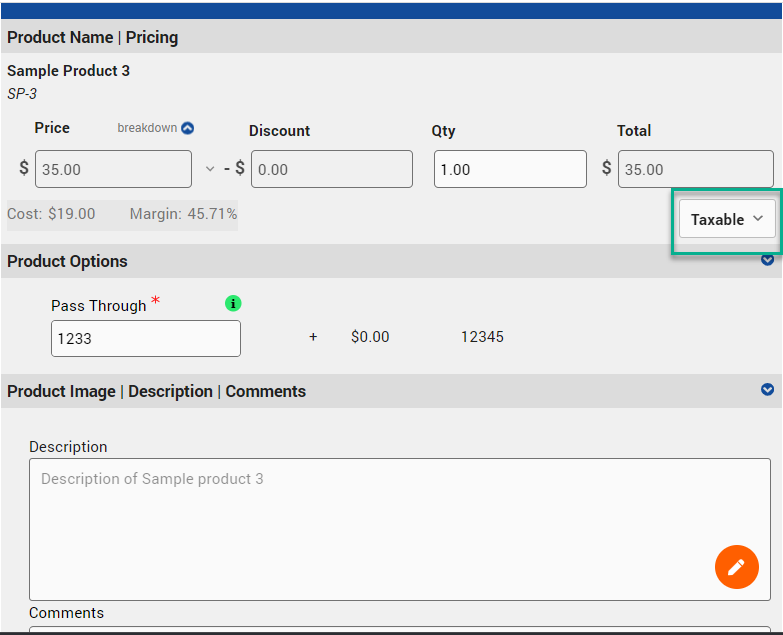

You can specify whether a product is taxable or not when you create or edit the product using the Taxes field. The options are Taxable or Non-Taxable. You can also create custom tax codes that could be used for applying different tax rates to different products on the quote. Click the orange Create New Tax Code button to create a new tax code.

You can define the tax rate in the Settings section of the quote table element. It can be a fixed amount, a %. formula, or conditional. If it is a %, then the percent is calculated based on the subtotal of all of the Taxable items in the quote. You can select which line items are used to calculate the tax by selecting the tax code in the For: drop down. Only items with the selected Tax Code will be used in the tax calculation.

The tax code of a product is displayed when you add a product in the quote editor. This can be edited for individual line items if needed.

Shipping, Additional Discount and any other custom subtotal fields that are not tax can be assigned a tax code.

If you have more than one tax, you can add a new field to the subtotal in the quote settings and label it as tax. You can edit the display name of the new field and even the default tax field.

Here is how the taxes display on the quote:

SHIPPING

Like the default tax field, the default shipping field can be defined as a flat rate , a % of the subtotal of all of the product totals, a formula, or conditional. You can leave the field as blank in the settings and have the user creating the quote input the amount, or you can define the % of fixed amount in the settings. You can change the display name of the shipping field and also add other fields for shipping. Here is an example:

OTHER FEES

You can add up to 10 subtotal fields that can be defined as other fees or credits. These can be percentage based, fixed formula or conditional. They can also be editable or non-editable by the the user creating the quote.